Good evening! Today we’ll cover Disney’s acquisition of 21st Century Fox and follow-up on what happened with Amazon’s fight with Google that we covered last week.

The post is a bit shorter than usual this time, both because I’m not that familiarized with the subject and because the year-end agenda is much heavier than usual. Also, there will probably be no posts for the next few weeks since I’ll be away on vacation.

On to the update.

Disney buys 21st Century Fox

From the Wall Street Journal:

Disney said Thursday it agreed to buy most of 21st Century Fox Inc. for $52.4 billion in stock, in a deal that would give Disney a dominant position in movies and sports and help bolster its flagging television business as it prepares to directly challenge digital giants like Netflix Inc.

[Bob Iger, Disney’s CEO,] said on a conference call that the deal will give Disney new film- and TV-production capabilities, plus franchises including Fox’s Avatar and the X-Men; expand Disney’s comparatively weak international television presence; and advance his goal of building direct relationships with consumers online.

Disney’s acquisition of Fox basically comes down to the company’s number one priority: owning and producing exceptional creative content. Just like its prior relevant acquisitions of Pixar (2006), Marvel (2009), and the “Star Wars” franchise (2012), the company is looking to remain dominant in this market, and this acquisition greatly improves its competitive position against incoming threats (read Netflix and Amazon Prime Video).

Disney’s business is broken down in 4 segments according to the company’s filings: (1) Media Networks, (2) Parks and Resorts, (3) Studio Entertainment, and (4) Consumer Products & Interactive Media. To simplify, I’d further aggregate these into two main categories: Parks and Merchandise (2+4), and TV and Films (1+3). The present acquisition concerns mainly TV and Films, which account for about 63% of the company’s operating income as of FY2017.

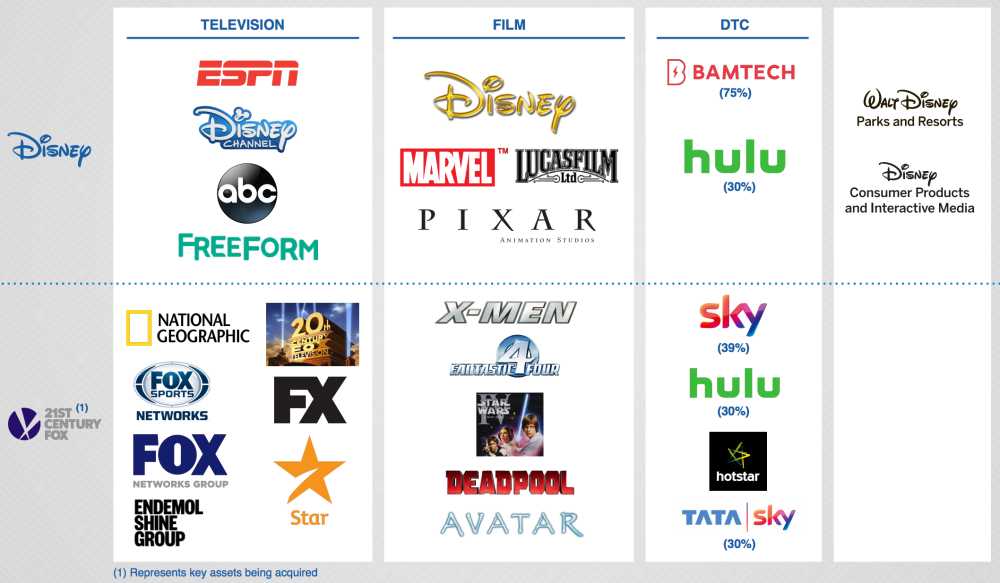

Here’s an overview of the assets being acquired, from Disney’s presentation:

Note that apart from our “Parks and Merchandise” category, every other segment receives substantial new additions from the deal. Let’s look at how these assets combine:

- First, ESPN, the regional Fox Sports networks (including US and LATAM), and Sky Sports (Europe) should promote collaboration, potentially exchanging content, talent and infrastructure, and leveraging distribution across regions.

- Second, the combined dominance in film production and franchise ownership should be evident by looking at the titles presented.

- Third, Disney is not only reaching a controlling share in the streaming service Hulu, but also acquiring a relevant international distribution service with Sky (which Fox should acquire entirely before merging with Disney).

- And fourth, the remaining distinct assets like National Geographic and FX are invaluable diversifications of quality content for Disney’s portfolio.

Like Bob Iger said in the article above, the rationale of the acquisition can be summarized in 3 main reasons: (1) TV and Film production capabilities (studios) and intellectual property (content/franchises); (2) stronger international presence (e.g. Sky); and (3) direct-to-consumer, or DTC (Hulu, plus content synergies).

At the end, it all comes down to owning the best content and controlling the distribution to consumers, and this deal seems to cover both issues very well.

That’s where the current industry situation kicks in: distribution. Customers are “cutting the cord” and canceling their TV subscription plans in favor of streaming subscriptions, especially Netflix. So cable networks are losing customers and profitability by the day, which concerns Disney’s biggest income source.

In light of this reality, Disney made a very good move last August when it announced that it would pull its content from Netflix and start its own DTC offerings. And the Fox acquisition is very accretive in this direction: DTC services depend on having loads of quality content so that consumers will feel the need to subscribe to the monthly service in order to access the exclusive content.

Here’s Bob Iger’s plan to execute this DTC strategy, from Disney’s transaction call:

If you think about our direct-to-consumer offerings, Hulu is sort of a more adult-oriented product using Fox Television production and FX; ESPN, obviously in the sports vein; and then Disney, Marvel, Pixar, Lucasfilm, the more family vein. That’s our current thinking.

Our current thinking regarding direct-to-consumer offerings is to create product that serves them well. And we believe that it is possible that a consumer may want to basically be choosy in terms of what product they want. Some may want pure family, some may want pure sports, some may want adult, some may want all of it, by the way, and certainly we will make that available.

So they’re breaking it down into 3 separate DTC services: family (Disney), adult (Hulu), and sports (ESPN). One might wonder why not bundle all of them (like Netflix), given that the economics of bundling usually make the service better for customers at no increased cost for the provider, which would lead to more pricing power. I can imagine three possible reasons:

- Not everyone wants sports, but those who do are willing to pay a big premium for that content, so it makes sense to separate the sports bundle from the rest and to charge much more for it, while allowing the uninterested to avoid that premium (even if diluted).

- The categories in question are very heterogeneous, so Disney might want to separate its content in different offerings to maintain the coherence of the brands and of what’s being shown to the user, i.e. to avoid showing cartoons to grown-ups and thriller movies to children.

- There is a current hype in favor of “skinny bundles”, so customers want to have the option to choose what they’re buying, even if it means getting less for more on aggregate.

To wrap up the topic, let’s cover regulation (it wouldn’t be Value Reads if we didn’t!). Even though this deal may sound very anti-competitive regarding content ownership and production capabilities, or when comparing against AT&T’s acquisition of Time Warner (which, by the way, share the content acquisition rationale with this one), I think there is a valid case for the authorities to approve this deal.

The industry is increasingly shifting towards streaming DTC offerings, and Netflix has a clear global dominance on that service type. Thus, allowing Disney to empower its offerings should promote competition instead of suffocating it, which is why I think the deal should go through with minimal constraints from the regulators.

Amazon backs down from Google fight

Complementing last week’s post, here’s what happened, from Bloomberg:

Amazon.com Inc. said it will start selling Google Chromecast gadgets again, extending an olive branch after the two internet giants clashed over the availability of their products on each other’s services.

The world’s largest online retailer reversed course on Thursday after Google recently blocked YouTube viewing on the Fire TV and Echo Show, two Amazon devices where watching video are popular features.

When it pulled YouTube, Alphabet Inc.’s Google cited the removal of the Chromecast from Amazon’s website as the reason. It also said Amazon wasn’t selling Google Home connected speakers, had stopped selling some Nest devices and hadn’t made the Amazon Prime Video streaming service available on Chromecasts.

Google has yet to respond to Amazon resuming Chromecast sales. It’s currently unclear if the change will push Google to resume YouTube support on Amazon’s devices.

Amazon declined to comment on whether it will now sell Google Home speakers and resume sales of new Nest devices along with Chromecast gadgets.

To believe Amazon is “extending an olive branch” is probably naïve. It is much more likely that Amazon is desperate to revert Google’s decision to pull YouTube from its devices, especially Echo Show.

That’s probably because dominating the home assistant market is one of Amazon’s top priorities today, so it is willing to forfeit some Prime Video bargaining power to acquire back an essential functionality to Echo Show.

But note that Amazon “declined to comment on whether it will now sell Google Home speakers”. It appears that they’re first throwing the Chomecast bait to see if Google will give them back what they want while they keep leveraging America’s largest e-commerce platform against their main competitor on the home assistant front.

Given Amazon’s demonstration of weakness, I think Google now has the opportunity to claim a place for its home assistant devices in Amazon’s platform. But selectively withholding an open website may be an expensive PR move for Google in the future, especially given that its practices are being closely followed by the antitrust entities.

You ought to be a part of a contest for one of the most useful websites online. I am going to highly recommend this website!

LikeLike